All about International Debt Collection

Wiki Article

An Unbiased View of Private Schools Debt Collection

Table of ContentsIndicators on Dental Debt Collection You Need To KnowThe Buzz on Dental Debt CollectionThe 10-Second Trick For Debt Collection AgencyThe Greatest Guide To International Debt Collection

:max_bytes(150000):strip_icc()/the-importance-of-a-debt-validation-letter-5114040-final-1393155b04274fa4b81452a5c431aac1.png)

The debt purchaser gets only a digital data of info, often without sustaining evidence of the debt. The financial debt is likewise normally extremely old debt, occasionally described as "zombie debt" because the debt customer attempts to revitalize a financial debt that was past the law of constraints for collections. Debt collection agencies might call you either in writing or by phone.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/PD7DY6QJL5C3ZM2U5JKN47NZKA.jpg)

Not speaking to them won't make the financial obligation go away, as well as they may just attempt alternate techniques to contact you, including suing you. When a debt enthusiast calls you, it is essential to obtain some first info from them, such as: The financial obligation enthusiast's name, address, and contact number. The overall quantity of the financial obligation they assert you owe, including any type of fees and passion fees that might have accumulated.

Business Debt Collection Fundamentals Explained

The letter must mention that it's from a financial debt collection agency. They need to additionally notify you of your rights in the financial debt collection process, as well as how you can challenge the debt.If you do challenge the debt within 30 days, they need to cease collection initiatives until they supply you with proof that the financial obligation is your own. They should give you with the name as well as address of the original creditor if you ask for that information within thirty day. The financial debt recognition notice have to include a form that can be made use of to contact them if you wish to dispute the financial obligation.

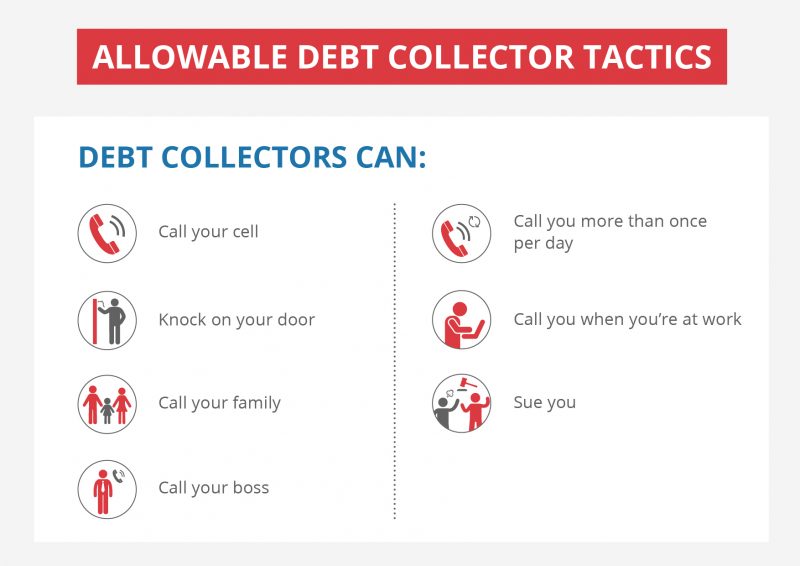

Some things debt collection agencies can not do are: Make repeated contact us to a borrower, meaning to frustrate the borrower. Endanger physical violence. Use profanity. Lie about exactly how much you owe or make believe to call from an official federal government office. Normally, debt is reported to the credit history bureaus when it's one month past due.

If your debt is transferred to a financial obligation enthusiast or offered to a financial debt customer, an access will certainly be made on your credit rating record. Each time your financial debt is a fantastic read offered, if it remains to go overdue, an additional access will certainly be included in your credit scores report. Each unfavorable entrance on your credit record can continue to be there for approximately 7 years, also after the financial obligation has been paid.

Unknown Facts About Dental Debt Collection

What should you anticipate from a collection company and also how does the process job? Keep reading to locate out. Once you have actually made the decision to hire a debt collector, make sure you select the best one. If you comply with the advice below, you can be positive that you've hired a reputable company that will site web certainly manage your account with care.For instance, some are much better at getting arise from bigger businesses, while others are knowledgeable at gathering from home-based services. Make certain you're dealing with a firm that will in fact offer your demands. This might appear noticeable, but before you hire a collection company, you need to make sure that they are certified as well as accredited to act as debt collectors.

Prior to you start your search, comprehend the licensing demands for debt collection agency in your state. By doing this, when you are interviewing firms, you can talk wisely about your state's needs. Examine with the companies you talk with to guarantee they meet the licensing requirements for your state, specifically if they are located in other places.

You must also contact your Bbb and also the Industrial Collection Agency Organization for the names of reliable and also extremely concerned debt enthusiasts. While you might be passing along Discover More these debts to a collection agency, they are still representing your business. You need to recognize just how they will certainly represent you, just how they will certainly function with you, and also what pertinent experience they have.

Not known Details About Business Debt Collection

Even if a strategy is lawful doesn't suggest that it's something you want your firm name associated with. A reputable financial obligation collection agency will certainly collaborate with you to set out a strategy you can cope with, one that treats your previous clients the method you would certainly wish to be treated as well as still does the job.If that occurs, one strategy numerous agencies use is miss mapping. That indicates they have accessibility to specific databases to assist find a borrower that has actually left no forwarding address. This can be a great strategy to inquire about specifically. You need to additionally explore the collector's experience. Have they dealt with firms in your market before? Is your scenario outside of their experience, or is it something they recognize with? Relevant experience raises the probability that their collection efforts will certainly be successful.

You should have a factor of contact that you can connect with as well as obtain updates from. Business Debt Collection. They must be able to plainly articulate what will certainly be gotten out of you in the procedure, what information you'll require to supply, and what the cadence and also causes for interaction will be. Your chosen company ought to have the ability to suit your picked interaction demands, not compel you to approve theirs

No matter whether you win such a case or otherwise, you desire to make sure that your business is not the one responsible. Ask for proof of insurance from any type of collection firm to safeguard yourself. This is usually called an errors and also noninclusions insurance plan. Financial debt collection is a service, and also it's not an affordable one.

Report this wiki page